Leveraging Generative AI for Internal Audit and Finance Transformation

The finance function is evolving rapidly, driven by automation, data-driven insights, and regulatory demands. One of the most impactful advancements is the adoption of Generative AI for Internal Audit, which empowers organizations to streamline audit processes, enhance accuracy, and strengthen compliance. In parallel, AI-powered finance agents are transforming how teams manage risk, reporting, and overall financial operations.

By integrating these AI-driven solutions, businesses can move beyond manual, error-prone workflows to achieve greater transparency, efficiency, and resilience in financial decision-making.

The Growing Role of Generative AI in Internal Audit

From Manual Reviews to AI-Powered Assurance

Traditional audit processes often involve time-consuming reviews, extensive document checks, and repetitive tasks that drain resources. By adopting Generative AI for Internal Audit, companies can automate evidence collection, validate transactions against compliance standards, and generate detailed audit reports in a fraction of the time.

Generative AI leverages advanced natural language processing (NLP) and large language models (LLMs) to analyze complex data sets, identify anomalies, and generate audit-ready documentation. This shift not only accelerates audit cycles but also reduces the risk of oversight, enabling auditors to focus on higher-value tasks such as risk assessment and strategic advisory.

Enhancing Risk Management and Compliance

AI-driven audits improve visibility into financial risks by continuously monitoring transactions, contracts, and internal controls. Instead of relying on periodic reviews, auditors can now access real-time alerts on irregularities, ensuring prompt action. Moreover, generative AI ensures compliance with evolving standards by dynamically aligning audit criteria with industry regulations.

Benefits of AI in Internal Audit

- Speed: Automates repetitive tasks, cutting audit timelines significantly.

- Accuracy: Reduces manual errors with AI-driven data validation.

- Scalability: Handles large volumes of financial records effortlessly.

- Compliance: Continuously maps organizational practices to global standards.

AI Agents for Finance: Driving Efficiency and Insight

What Are Finance AI Agents?

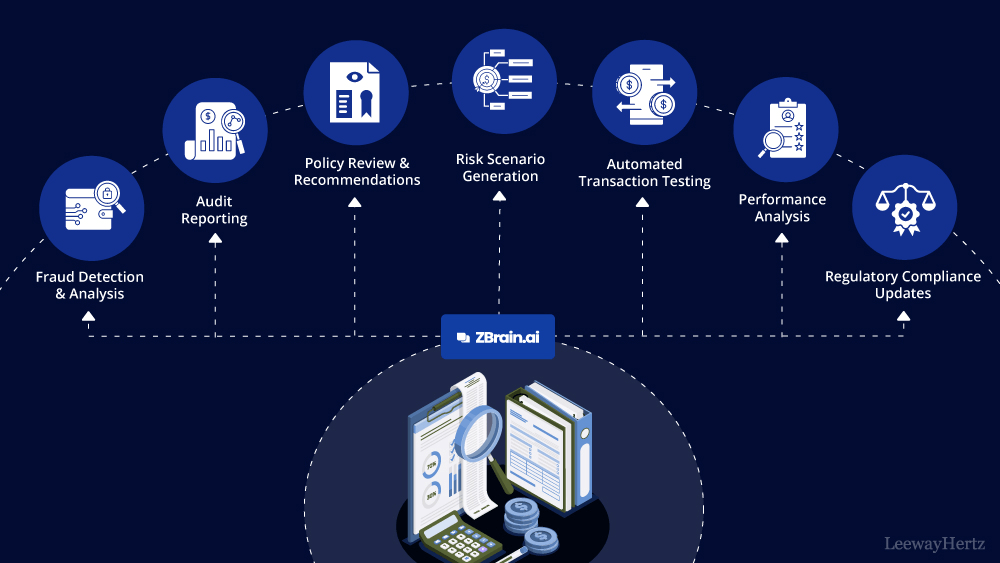

Beyond auditing, finance teams are embracing AI agents to automate reporting, forecasting, and compliance validation. Finance AI agents are intelligent systems designed to perform specialized tasks such as reconciling accounts, validating invoices, drafting contracts, or analyzing risk.

These agents are pre-trained on domain-specific knowledge and can integrate with enterprise systems like ERP, CRM, and accounting software. They act as “co-pilots” for finance professionals, enabling them to work faster and with greater confidence.

Key Use Cases of Finance AI Agents

- Accounts Payable and Receivable Automation: Automates invoice validation, payment reconciliation, and remittance processing.

- Contract Management: Drafts, validates, and monitors contracts against compliance standards.

- Financial Planning and Analysis: Generates forecasts, scenario models, and performance dashboards.

- Audit and Compliance Support: Works in sync with internal audit functions to provide real-time risk insights.

Why Finance Teams Are Adopting AI Agents

- Time Savings: Eliminates manual, repetitive work.

- Cost Efficiency: Reduces overhead and operational expenses.

- Data-Driven Decisions: Provides actionable insights in real time.

- Risk Reduction: Identifies anomalies before they escalate into compliance issues.

How Generative AI and Finance AI Agents Work Together

A Unified Approach to Financial Oversight

Generative AI enhances audits by ensuring compliance and accuracy, while finance agents streamline daily workflows. Together, they create a comprehensive ecosystem where risk management, compliance, and efficiency are tightly integrated.

For instance, a finance agent can automatically validate invoices and flag irregularities, while generative AI ensures that these transactions align with audit criteria. This combined approach strengthens financial governance and builds stakeholder trust.

Bridging Human Expertise and AI Intelligence

AI does not replace auditors or finance professionals; instead, it enhances their capabilities. By taking over routine tasks, AI allows finance teams to focus on strategic functions such as investment analysis, business expansion, and advisory roles. Human expertise paired with AI intelligence creates a synergy that drives sustainable business growth.

Future of AI in Finance and Auditing

The future of finance will be defined by intelligent automation and AI-driven decision-making. Generative AI and finance agents are not just short-term tools—they are foundational to building resilient, future-ready financial systems. Organizations that adopt these solutions early will gain a competitive edge by ensuring compliance, minimizing risks, and unlocking strategic insights at scale.

Trends to Watch

- Continuous Auditing: Always-on AI-powered audit cycles.

- Predictive Compliance: AI forecasting regulatory risks before they occur.

- Autonomous Finance Operations: End-to-end financial workflows managed by interconnected AI agents.

- Human-AI Collaboration: A shift from oversight to strategic partnership between finance teams and AI.

Conclusion

As finance teams navigate complex challenges, Generative AI for Internal Audit and Finance AI agents are emerging as indispensable solutions. They not only automate tedious processes but also enhance compliance, accuracy, and decision-making. By combining the strengths of AI and human expertise, organizations can transform their financial operations into agile, transparent, and future-ready systems.